Heloc amortization calculator

The mortgage amortization period is how long it will take you to pay off your mortgage. Lenders typically loan up to 80 LTV though lenders vary how much they are willing to loan based on broader market conditions the credit score of the borrower.

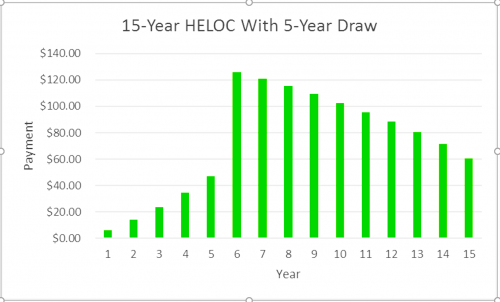

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

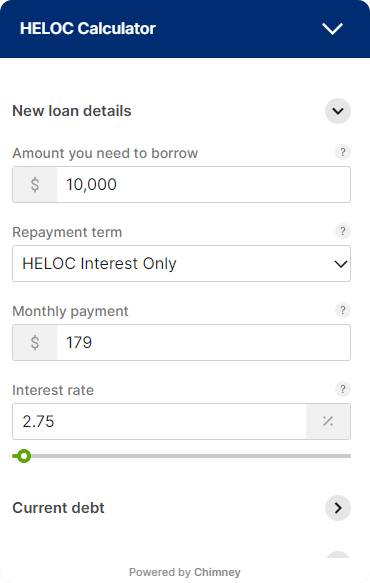

Since borrowers only pay interest in the interest-only period the HELOC amortization schedule for that period will be just for interest payments and 0 for the principal.

. Here is an example amortization schedule for a loan with the following characteristics. We look at the effect of making the same overpayment each month with our calculator. Top Reasons Not to Use a HELOC.

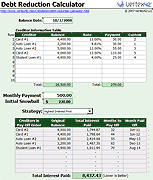

See how those payments break down over your loan term with our amortization calculator. A borrower can see how much total interest payments payoff day and the total payment on the loan maturity day. The most common mortgage term in Canada is five years while the most common amortization period.

Our Excel mortgage calculator spreadsheet offers the following features. Calculate balloon mortgage payments. A balloon mortgage is usually rather short with a term of 5 years to 7 years but the.

When you make an overpayment after the loan has commenced they add to your normal monthly mortgage payment. The HELOC calculator can be used to determine the total eligible loan amount. Our Mortgage Overpayment calculator enables you to understand what amount of interest and the amount of time you can save by making a regular overpayment.

Arguably the best Amortization mortgage calculator. Allows extra payments to be added monthly. Instant Amortization table for any rate you choose.

For more information on amortization take a look at our amortization calculator to learn more about how loans are amortized. A balloon mortgage can be an excellent option for many homebuyers. HELOC Payment Calculator For a 20 year draw period this calculator helps determine both your interest-only payments and the impact of choosing to make additional principal payments.

Shows total interest paid. The HELOC payment calculator generates a HELOC amortization schedule that breaks down each monthly payment with interest and the principal amount that a borrower will be paying. 15000 to 750000 up to 1 million for properties in California.

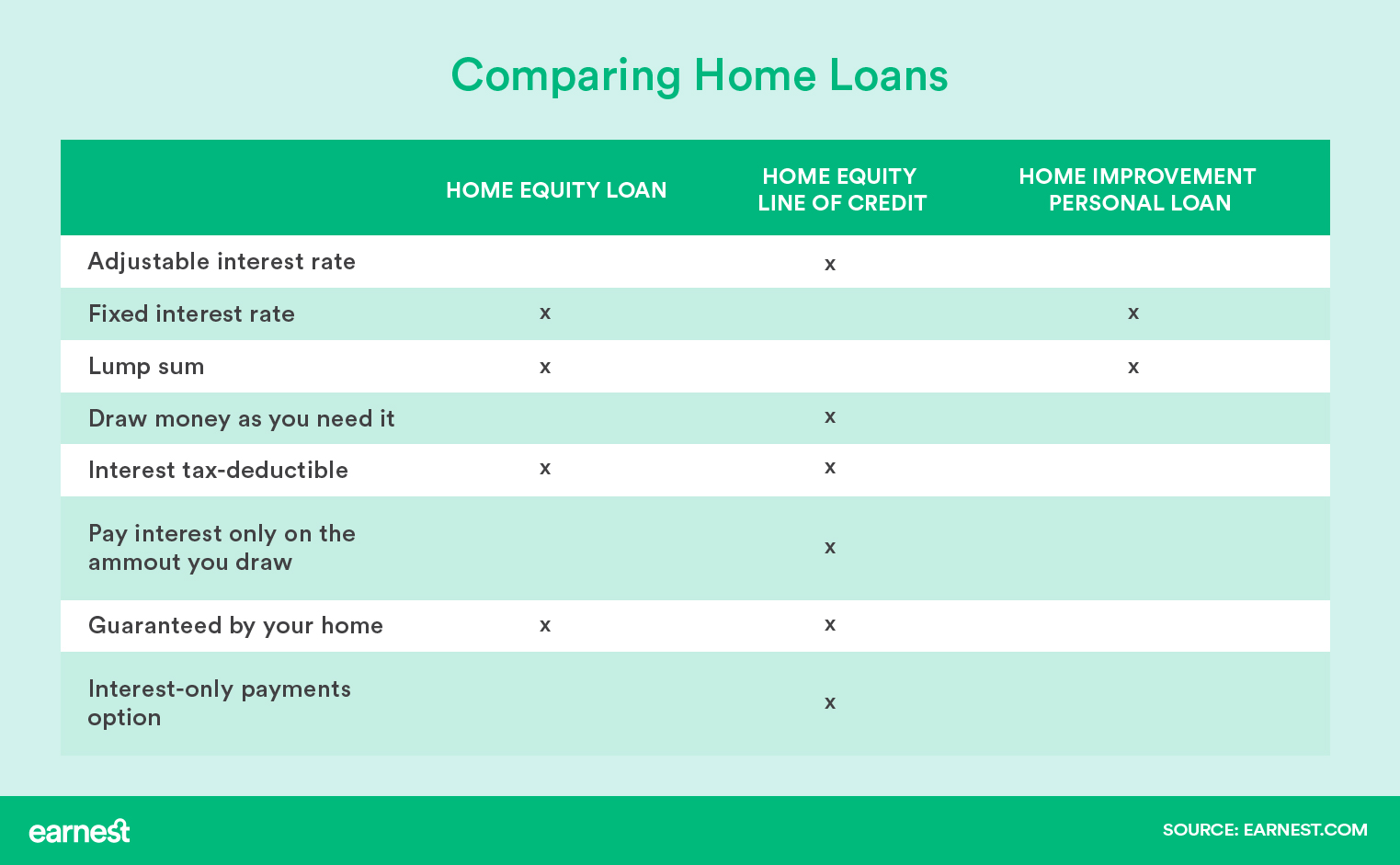

Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. Rates are adjustableHELOCs are adjustable-rate loans and HELOC rates are based on two components. Some of them use creative Excel formulas for making the.

For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three. The loan amortization calculator generates an amortization table that shows the principal interest total payment and the remaining balance for each payment. Home Equity Loan Amortization Calculator.

The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. How does the HELOC Payment Calculator work. It can also display one additional line based on any value you wish to enter.

Payment Calculator with amortization schedule to calculate any type of loan payments. Change payment and calculate years to payoff. The mortgage amortization schedule shows how much in principal and interest is paid over time.

The calculator gives. Calculate a 45 Mortgage Payment. Our HELOC payment calculator determines the monthly payment on your HELOC.

The payment calculator will show you the monthly payment and how much of that amount is for principal and how much is. The calculator updates results automatically when you change. Extra Payment Mortgage Calculator - Compares making extra payments to investing.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. You can also find a free excel loan amortization spreadsheet by doing a search in Excel after going to File New. Auto Loan Amortization Calculator.

A set base rate called a margin plus a fluctuating rate called an index The index for HELOCs is the Prime Rate which is a rate that changes as the Fed adjusts rates throughout each year. Once created amortization schedules hold true until one or more of the variables used to create them changes. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for.

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Heloc Calculator How To Get To Your Payoff Date Youtube

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Loan Vs Line Of Credit Vs Home Improvement Loan Earnest

Home Equity Loan Calculator By Creditunionsonline Com Calculate Home Equity Loan Payments

Heloc Calculator

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Mortgage Payoff Calculator With Line Of Credit

Home Equity Loans Selco

Mortgage Payoff Calculator With Line Of Credit

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

Looking For A Heloc Calculator

Home Equity Line Of Credit Qualification Calculator